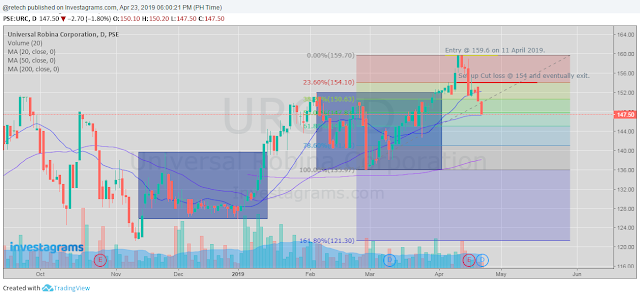

Breakout trade

Stock: URC

Entry: 159.6

Exit: 154

Result: Loss

Further to my study about stock trading, I read about Darvas Box and tried to use this set-up but I think I used it wrong.

So my bias is that It will break out at the second box that I plotted (see above). But It went against me.

With what I learned from reading the book "Think & Trade Like a Champion"

So, with the above Darvas plotting and the 20, 50 and 200 MA I entered the trade @ 159.6 and set a 4.66 % stop loss at 154.

Well, as I said, I think the setup was wrong. As I look at it now, It seemed that URC has finished the one month upward run and in on its way to reverse the trend the day I entered. Glad about the stop loss and the discipline I learned from the book. I pull the plug without hesitation and learned from my first losing trade.

My takeaways on this trade.

- The book also told about stock selection process and criteria but was not able to use it religiously. The book mentioned about 8 criteria to consider before buying a stock. Next trade, I'll focus on those 8 criteria.

- I'll study more about the right execution of Darvas.

- I studied also about the Fibonacci retracement and it seemed I can still consider URC on a bounce as it hit now the 50%. I just don't know. Anyway, madami pang kakaining bigas. Aral pa ulit.

- Next trade hint: I tried intraday and caught a stock that was surging up and ride the momentum.

No comments:

Post a Comment