Saturday, January 16

Saturday, December 19

Finally guys natapos ko na din ang pinakabong video-series na ginawa ko this month. This is the CALMA Strategy Complete Guide, a 3-video series tackling the second most famous trading strategy ng Trader's Lounge na ngayon ay Trader's Den na. So, below I provided the link of those there videos for your easy reference.

So, what's CALMA Strategy?

CALMA Strategy is a trading strategy that I learned from Traders Lounge. It is a trading strategy most suitable to those who don't have time to monitor the market for the entire trading day. The time frame is weekly that's why it doesn't require someone to monitor the price movement the entire day. Most suitable to those who are working 8 to 5 job in the Philippines, and to OFWs also that were on different time zones.

So if you wanted to learn CALMA Strategy consider watching all the videos I created below:

1. Introduction - https://youtu.be/pJMYnDIirS4 2. Buy Parameters - https://youtu.be/SOKYuE6VW4o. 3. Sell Parameters - https://youtu.be/1oh5nj2CZ2k.

Saturday, October 17

Tuesday, September 29

Sunday, September 20

Monday, September 14

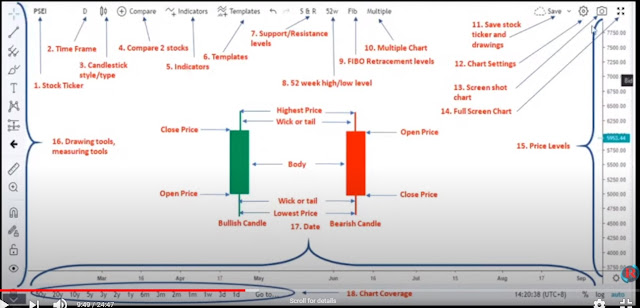

- Stock Ticker: https://www.youtube.com/embed/p4colUWeZFk

- Time Frame: https://www.youtube.com/embed/Lh6r646OjWU

- Candle Stick Style/Type:

- Compare tool:

- Indicators:

- Templates:

- Support/Resistance levels:

- 52week High/Low levels:

- FIBO Retracement Levels:

- Multiple Chart:

- Save:

- Chart Settings:

- ScreenShot:

- Fullscreen:

- Price Levels:

- Drawing/Measuring tools:

- Time/Date:

Thursday, September 10

- Stock Ticker: https://www.youtube.com/embed/p4colUWeZFk

- Time Frame: https://www.youtube.com/embed/Lh6r646OjWU

- Candle Stick Style/Type:

- Compare tool:

- Indicators:

- Templates:

- Support/Resistance levels:

- 52week High/Low levels:

- FIBO Retracement Levels:

- Multiple Chart:

- Save:

- Chart Settings:

- ScreenShot:

- Fullscreen:

- Price Levels:

- Drawing/Measuring tools:

- Time/Date:

Tuesday, September 8

Hello, newbie traders out there!

- Links of all the videos discussing all the parts of a stock chart.

- Links of websites you can visit for further studying/reading.

- Links of other videos/Youtube channels for further viewing/understanding.